The link to this blog will be provided in all cases where EB-3 candidates request information about the status of a pending application - PERM or PWD potentially impacting them - on file with the U.S. Department of Labor. Personalized updates are not possible. Please check here first rather than emailing or messaging us in future months. The DOL releases processing statistics for the prior month 5-10 days after it ends and we will make every effort to update our write-ups within a few days of that. We will discuss the processing times that are currently posted below and can be found at: https://flag.dol.gov/processingtimes

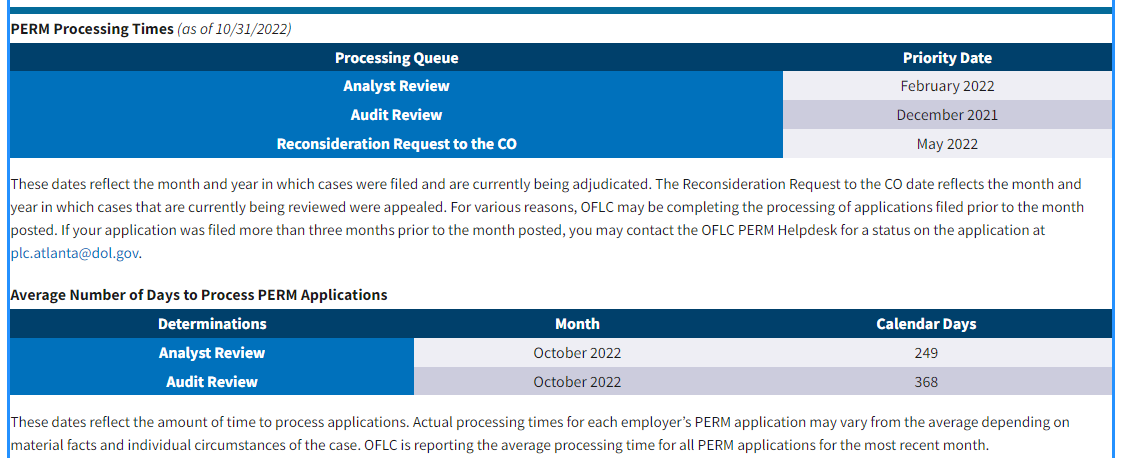

First, PERM processing times are about 8 months currently. The data below shows this. The median processing time is about 249 days from filing. In October (month 10 of the year), they were up to February (month 2) cases. Obviously, when a case was filed within the month of February makes a key difference here - someone filed February 28th should expect their case processed a month later than someone whose was filed on February 1st.

Wage determination request processing time are often mistaken for PERM processing data or otherwise misinterpreted for some reason. As of October 31, 99+% of wage determinations filed in December had been processed and nearly all of the January through March ones had along with a sizable minority of Aprils. However, the key to these data point is to look at the bigger picture. What this says is “if the prevailing wage impacting my case was requested in March and I have no heard yet, I should expect to hear very very soon; if it was in April or even may there is somewhere from a very good to ok chance that we will hear in November.” THIS IS NOT PERM DATA, though. This only involves wage determination requests.

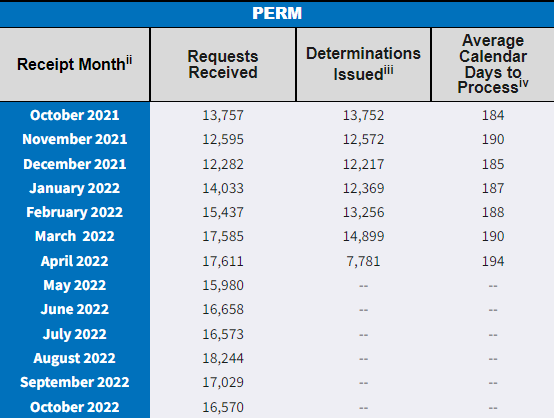

A final note is that the DOL releases quarterly data because it is required to by law an accountability measure to Congress and the taxpayers who fund its operation. The quarterly data is absolutely not released as a mechanism by which PERM candidates/beneficiaries can reliably track their cases.